This Simple Habit Shift Every Small‑Business Owner Needs

For many small business owners, especially in the early stages of growth, it’s common to blur the lines between personal and business finances. It may start with a quick purchase using the wrong card or reimbursing yourself informally for supplies but over time, these habits can create significant problems when it comes to bookkeeping, tax reporting, and financial planning.

At Titan Tax Solutions, we regularly assist clients who have unintentionally mixed their business and personal expenses. While it’s a common issue, it’s one that can lead to missed deductions, disorganized records, and in some cases IRS scrutiny. Fortunately, the solution lies in establishing clear financial boundaries and systems from the start.

Why Keeping Business and Personal Finances Separate Matters?

1. It Simplifies Your Bookkeeping

When business and personal transactions are clearly separated, your financial records remain organized. Your accountant or bookkeeper can quickly categorize expenses and reconcile accounts without spending hours trying to determine what belongs where.

2. It Preserves Deductibility

Blended records make it harder to track legitimate business expenses. This can result in missed deductions or, conversely, the unintentional deduction of personal costs which could raise compliance concerns.

3. It Reduces Audit Risk

The IRS expects well-documented and clearly separated financial records. Commingled accounts can lead to questions about the legitimacy of expenses, which may increase the likelihood of an audit or trigger additional inquiries during tax filing.

4. It Maintains Financial Credibility

Clean records not only help with taxes, but also enhance your financial transparency when seeking loans, bringing on investors, or making strategic decisions. Organized, audit-ready financials demonstrate professionalism and reliability.

Best Practices for Keeping Business Finances Separate

Establishing good habits early can prevent issues down the road. Here are several key practices to follow:

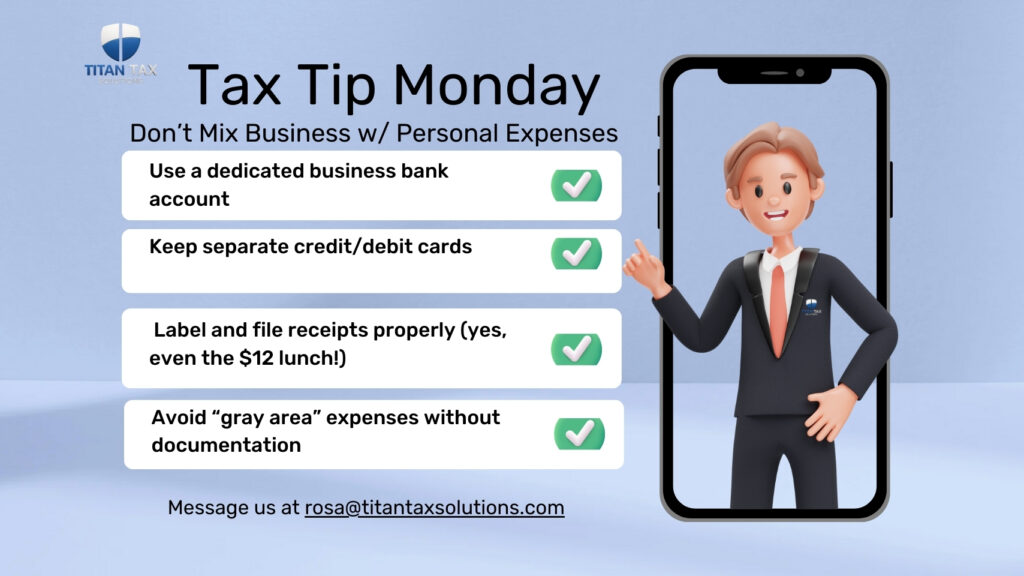

➤ Open a Dedicated Business Bank Account

All income, expenses, and payments related to your business should flow through a business-only checking account. This provides a clear financial trail and reduces confusion during reconciliation.

➤ Use a Business Credit Card

Keeping business purchases on a dedicated card allows for better expense tracking, easier monthly reporting, and a clearer separation of spending categories.

➤ Label Expenses Immediately

Make it a habit to note the purpose of each business expense as it occurs. Many accounting apps allow for real-time tagging, which helps maintain context when reviewing records later.

➤ Store Receipts with Notes

Maintain digital or physical copies of receipts, and document the business purpose. This is especially important for expenses that could be questioned later (e.g., meals, travel, or supplies).

➤ Pay Yourself Consistently

Rather than using business funds for personal needs, set up a structured owner’s draw or salary. This reduces the temptation to make informal withdrawals and helps preserve accurate records.

What If You’ve Already Mixed Business and Personal Expenses?

If you’ve already made this mistake, don’t panic. It’s possible to untangle mixed records with a thoughtful approach and support from an experienced accountant or bookkeeper.

At Titan Tax Solutions, we help clients:

- Reclassify and clean up financial records

- Review and organize past expenses

- Implement systems for proper expense tracking moving forward

- Stay compliant with IRS regulations and audit standards

Mistakes are fixable. What’s important is adopting better practices going forward.

Here is a Final Thought About This.

Maintaining a clear line between business and personal finances is one of the most important steps small business owners can take to protect their business and ensure smooth tax preparation. While it may take a little effort up front, the benefits of cleaner books, fewer headaches, stronger deductions, and lower risk far outweigh the inconvenience.

If your business is growing, or if you’re unsure whether your current practices are sufficient, consider consulting with a financial professional. Clear, accurate records are essential to confident business decisions, and long-term success.

Need help reviewing your current financial setup?

Connect with Titan Tax Solutions for guidance on setting up clean, compliant systems that grow with your business.