In today’s evolving healthcare economy, running a profitable dental practice goes far beyond clinical expertise. Behind every successful dental clinic is a sophisticated financial strategy. At the center of that strategy is a Chief Financial Officer (CFO).

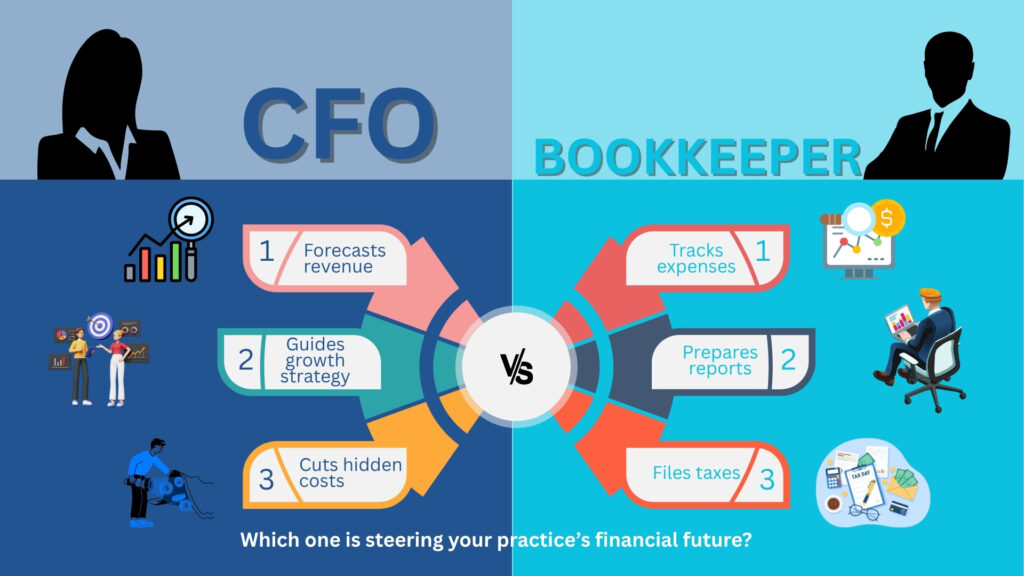

Many dental professionals tend to rely excessively on a bookkeeper or CPA for their finances, but this approach often leaves critical value on the table. A CFO brings strategic insight, operational alignment, and high-level financial planning that drive profitability, reduce inefficiencies, and support long-term scalability.

Whether you’re a solo practitioner or a multi-location clinic, partnering with a dedicated CFO accounting services provider could be the turning point for the growth of your business.

What does a CFO Really do?

Did you know that bookkeeping and tax preparation are just the tip of the iceberg when it comes to managing your dental practice finances?Yes, these are essential, no doubt to that. However, bookkeeping and tax preparation mainly focus on historical data, from what 2,3,5 years past. Yes, it is essential to look at historical data but beyond those numbers there are other factors that have to be considered when making financial decisions. With the fast changing economical, political, and even ecological factors, these historical data could sometimes be far obsolete.

So, you ask me, what could be done then if that would be the case? Here comes the Chief Financial Officer we commonly known as the CFO. A CFO, unlike a bookkeeper and tax preparation, can bring a forward-looking, strategic lens to your financial operations. They don’t just report numbers but rather use these numbers to make interpretations, identify patterns that a bookkeeper might not have the eyes to see, and moreover, provide actionable insights to fuel smarter decisions and sustainable growth.

You ask me, what do you get when you partner with a trusted CFO services group? To name a few, here are what could be the top 4 benefits your practice could gain from a CFO partner:

✅ First, you’ll get an ACCURATE FINANCIAL FORECASTING. For starters, accurate financial forecasting allows you to plan for seasonal trends. It also gives you a wider vision of your patient flow and more importantly you can plan for your revenue target more precisely.

✅ Second, you can get hold of an ADVANCED COST ANALYSIS. When you have advanced cost analysis, you’ll uncover some hidden inefficiencies in your financial flow which you can adjust accordingly and as a result you’ll get to reduce unnecessary spending.

✅Third, you’ll be able to achieve a more STRATEGIC BUDGET ALIGNMENT. With a better strategic budget alignment you’ll get to ensure that every dollar is working towards your long-term goals.

✅And the fourth but equally important is that you’ll get a better REVENUE & PROFIT MODELLING. With a trusted CFO you’ll get to identify your most profitable services which you can even enhance to get more profit and with that sorted you’ll get clearer opportunities for expansion.

In simple words, your bookkeeper tells you what happened to your finances in the last year(s) but your CFO tells you what are the possibilities in your business and gives you a clear actionable idea on how to get there.

Increase Profitability Without Compromising Patient Care

Most dental practice are losing money and don’t even realize it. Most often than not, profit leaks and it goes year in year out and not even noticed, silently eroding the bottom line month after month. Common culprits include:

- Inefficient scheduling and underutilized clinical staff

- Poorly negotiated vendor, lab, or supply contracts

- Rising fixed costs and unchecked overhead expenses

These issues may seem small in isolation, but together they can significantly impact your profitability. That’s where a seasoned CFO services group steps in. With expert financial oversight, these inefficiencies are not only uncovered but systematically resolved. Your CFO will:

✅ Conduct in-depth cost-benefit analyses across all expense categories

✅ Analyze and improve chairside efficiency metrics

✅ Focus on optimizing high-margin procedures and reducing financial waste

How would this affect your business?

Seriously, you’ll get to increase your net profit without adding more patients, working longer hours, or raising fees. Just smarter, data-driven financial management that supports sustainable growth.

Smarter Investments, Better Patient Growth

You told me you’re thinking of expanding your clinic, maybe adding new operatories, investing in marketing, or bringing in state-of-the-art equipment.

These are exciting moves, but they’re also major financial decisions that can either accelerate your growth or strain your cash flow if not carefully planned. That’s exactly where a trusted CFO services LLC makes all the difference. With the right financial partner by your side, you’re not just guessing “will this work or not”, instead you’re making confident, strategic investments that align with your long-term goals.

How can a CFO helps turn bold ideas into smart action:

✅ Evaluate ROI on digital marketing campaigns and local outreach initiatives

✅ Analyze lease vs. buy options for new equipment based on real cash flow projections

✅ Forecast break-even points for new services or expanded facilities

With this level of insight, you’re not growing blindly, you’re scaling with clarity, control, and a strategy that ensures every investment pays off.

Streamlined and Strategic Insurance Reimbursements

Well, everyone in America is dealing with medical or dental insurance and if you run a dental practice, you already know what a headache that can be.

From delayed payments to denied claims and frustrating compliance rules, insurance billing can feel like a constant uphill battle. And when it’s not managed well, it directly impacts your cash flow.

However, with a great CFO accounting service it is half the problem solved. Of course, they are not going to replace your billing team, but they are going to bring structure, strategy, and oversight to keep things running smoothly.

How does a CFO support your billing process? Simple, I can tell you three checks:

✅ Keeps a close eye on A/R aging and insurance reimbursement trends

✅ Flags recurring coding issues before they become costly problems

✅ Works with your billing staff to shorten the payment cycle and speed up collections

With the right CFO in your corner, your practice collects faster, bills smarter, and sees a major improvement in cash flow with less stress for everyone involved.

Take Control of those Payroll, Vendors & Technology Spending

Let’s be honest payroll and vendor costs can quietly eat away at your profits if left unchecked. For most dental practice, these are the biggest expense categories, yet they’re often the least optimized. That’s why bringing in a strategic CFO service is a game-changer. Your CFO ensures that every dollar spent is working hard for your practice and not just adding to overhead.

How could that be possible? Here’s the bullet points:

✅ Benchmark payroll against national and industry standards to ensure you’re competitive but not overspending

✅ Design incentive plans that motivate your team and align with production goals

✅ Negotiate better rates with labs, suppliers, and service providers to reduce waste

✅ Evaluate ROI on new technologies like CAD/CAM, AI diagnostics, and 3D imaging so you invest only in what truly adds value

With the right CFO accounting service, you gain financial clarity, reduce unnecessary spending, and still deliver the high-quality care your patients expect without compromise.

Is Your Dental Practice Ready for What is Next?

That is a good question to ask and begin pondering with.

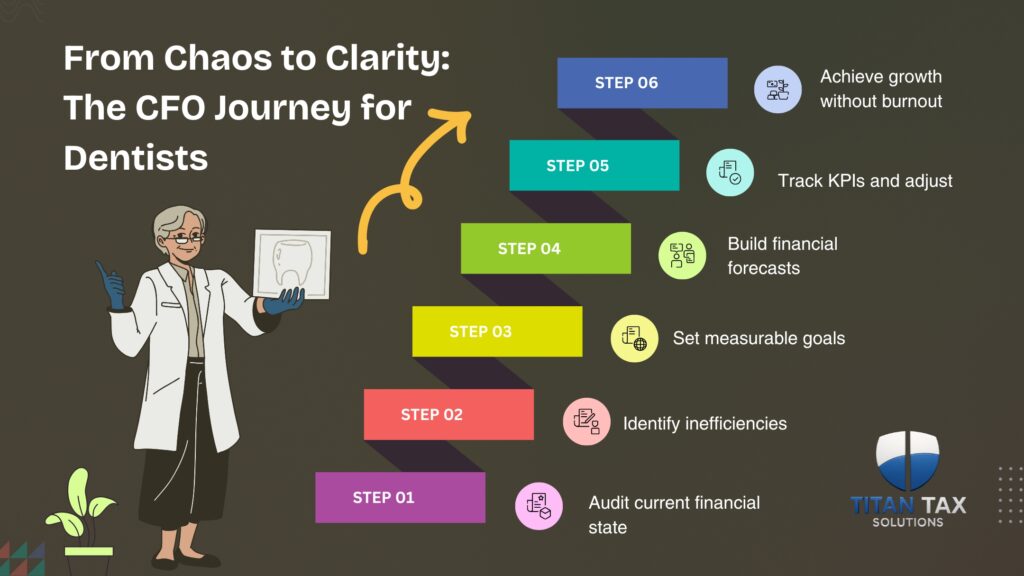

If your dental practice has hit a revenue plateau, experienced cash flow challenges, or feels stuck without a clear financial direction it’s a sign you need more than basic bookkeeping.

It’s time to bring in expert-level support.

I tell you, even on a fractional basis, a seasoned CFO can make a measurable difference by providing the strategic insight and financial leadership your clinic needs to thrive.

At Titan Tax Solutions, we specialize in CFO services tailored specifically for dental practice. Our experienced team helps high-performing clinics shift from reactive decision-making to proactive, data-driven growth.

We don’t just organize your numbers, instead we turn them into a roadmap for smarter operations, higher profit margins, and sustainable success.

Elevate Your Dental Practice Now Before It’s Too Late?

You’ve worked hard to build a thriving dental clinic but if you’re feeling the pressure of rising costs, stalled growth, or financial uncertainty, you’re not alone. The good news is, you don’t have to figure it all out on your own.

At Titan Tax Solutions, we take a personalized, hands-on approach through our CFO services group designed specifically for dental professionals like you. Whether you’re exploring CFO accounting services for the first time or need a strategic partner to guide your next big move, we’re here to support you.

✅ Let’s uncover hidden profit opportunities

✅ Strengthen your systems without overwhelming your team

✅ And build a financial strategy that supports your growth without the burnout

For more updates and details visit our Facebook Page!